Submit your tax return online by 31/01/23 to avoid a fine!

IF YOU are self-employed, or were self-employed for any part of the tax year April 2021 to April 2022, you now have until 31 January 2023 to send in your tax return online for 2021-22. That's less than 90 days, so really not very far off.

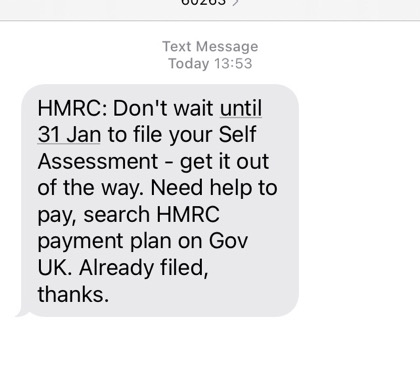

Her Majesty's Revenue and Customs (HRMC, the tax people,) will send you periodic reminders to do you tax return if they have your mobile number

There are automatic fines in three figures for those who are required to fill in a self-assessment tax return and fail to do. So don't say we didn't warn you!

Yes, there were last-minute extensions to the deadlines granted for submitting your tax return in the last two years. But these were both exceptional covid years: we cannot expect such grace periods this time around.

Some of us took an unexpected hit to their income due to the economic impact of the covid pandemic during tax year 2021-2022. So the sooner we get our returns in, the sooner we will get some kind of tax rebate if we are eligible for one.

Older readers may remember SEISS, the now-defunct Self-Employement Income Support Scheme payments that saw some self-employed folk through lean times of no income during Covid. If you received any such payments in tax year 2021-2022, we remind you that these benefits count as taxable income and you have to declare them. You can quickly check how much you received in SEISS grants in that tax year here.

We have heard that some freelances made a lot more money than expected in the same tax year due to some higher-than-expected payments for secondary uses of their work via the Authors Licensing and Collection Society (ALCS). See here for how authors can benefit from ALCS. Photographers and illustrators should see here for details of their equivalent, the Design and Artists Copyright Society - DACS.

We remind members also that any income from ALCS is declarable. You should do some tax planning, as higher than expected SEISS or ALCS pay-outs - especially coming at the end of the tax year - may push your earnings over the "allowance" threshold at which you have to start paying (more) tax.

IR 35

In a disastrous recent non-budget Kwazi Kwarteng, who was briefly Chancellor of Exchequer, promised changes to the IR35 tax rules on individuals who set themselves up as "service companies".

These changes would have shifted responsibility for proving that such freelances could offer service as a service company rather than as an employee to the freelance. This briefly promised to make it more advantageous for some freelances to operate through a service company.

If you were considering doing so, be aware that the promise of changes to IR35 was reversed by current Chancellor Jeremy Hunt in his more recent mini-budget. Clients engaging freelances to do work for them via service companies again have to police the lawfulness of such arrangements under tax regulations and face sanctions if they fail to do so.

Making tax digital

The current government plans to force absolutely all self-employed folk to sign up to the truly awful Making Tax Digital plan by April 2024.

This will require us to submit accounts four times a year instead of annually. At the moment, only those with an annual turnover which reaches the threshold of having to pay Value Added Tax (VAT) - £85,000 a year - have to endure this obligation. See the Freelance Fees Guide advice on VAT.

Logging in to file your tax return

Before you can file your tax return online you have to log in. You should make sure very soon that you can still do this, and that you haven't lost or forgotten user names and passwords. You can now log in only with HMRC's Government Gateway ID number and password. The GOV.UK Verify service has now ended.

Registering a new Government Gateway account can take some time. So can recovering your password if you had one long ago and have forgotten it - and especially long if you have forgotten your "recovery word". Things will have to be sent to you in the post. So do it now.

Are you newly self-employed?

Members who became self-employed in tax year 2022-2023 and who haven't told HMRC should contact it now for advice on setting up a Government Gateway account, registering with HMRC as self-employed, getting a Unique Tax Reference number and all the rest of it.

![[Freelance]](../gif/fl3H.png)