Submit your tax return online by 31/01/24 to avoid a fine!

IF YOU are self-employed, or were self-employed for any part of the tax year April 2022 to April 2023, you now have until 31 January 2024 to send in your tax return online for 2022-23. That's really not very far off.

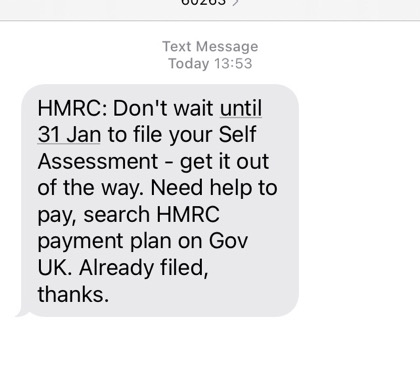

Her Majesty's Revenue and Customs (HRMC, the tax people,) will send you periodic reminders to do you tax return if they have your mobile number

There are automatic fines in three figures for those who are required to fill in a self-assessment tax return and fail to do. So don't say we didn't warn you!

We remind members also that any income from ALCS or from DACS is declarable.

Making tax digital - but not yet

The UK government has long planned to force absolutely all self-employed folk to sign up to the truly awful Making Tax Digital plan.

This will eventually require us to submit accounts four times a year instead of annually. At the moment, only those with an annual turnover which reaches the threshold of having to pay Value Added Tax (VAT) - £85,000 a year - have to endure this obligation. See the Freelance Fees Guide advice on VAT.

Late last year this scheme was postponed again.

The current guidance - updated on 19 December 2022 with little fanfare - is:

You need to follow the requirements for Making Tax Digital for Income Tax if you are self-employed or a landlord from:

- 6 April 2026 if you have an annual business or property income of more than £50,000

- April 2027 if you have an annual business or property income of more than £30,000

Logging in to file your tax return

Before you can file your tax return online you have to log in. You should make sure very soon that you can still do this, and that you haven't lost or forgotten user names and passwords. You can now log in only with HMRC's Government Gateway ID number and password. The GOV.UK Verify service has now ended.

Registering a new Government Gateway account can take some time. So can recovering your password if you had one long ago and have forgotten it - and especially long if you have forgotten your "recovery word". Things will have to be sent to you in the post. So do it now.

Are you newly self-employed?

Members who became self-employed in the relevant tax year and who haven't told HMRC should contact it now for advice on setting up a Government Gateway account, registering with HMRC as self-employed and getting a Unique Tax Reference number if you do not already have onea.

Advice for NUJ members

The Freelance office has arranged with accountants HW Fisher for them to produce a free tax guide for members: see here.

Authors and Freelance Journalists Tax Guide 2023/24 www.hwfisher.co.uk

Authors and Freelance Journalists Tax Guide 2023/24 www.hwfisher.co.uk

![[Freelance]](../gif/fl3H.png)