Yet more advice in the Freelance Fees Guide

WE PROUDLY present yet more advice in the Freelance Fees Guide. There are two entirely new sections:

- Visas and paperwork for travel for work - what do you need to do to stay the right side of the law when you work in joined-up Europe? Yes, it's partly a collation of our Brexit reporting now that the dust has settled a bit.

- Benefits and pensions: sadly, we feel the need to reflect the insecurity of freelancing with outline advice on getting money when you cannot work. There is also a roundup of non-state support.

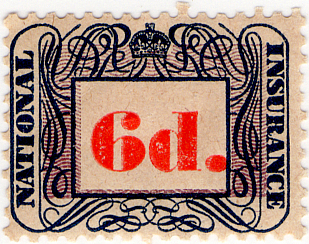

Back in the day, you proved your entitlement to a pension by buying actual stamps and sticking them in a book. This one's from 1948, the year of creation of the National Health Service

We have also updated the section on Tax and National Insurance to explain the changes that took efffect in the UK at the start of the tax year - 6 April - and in this month's Budget.

Here we stress the importance of topping up your National Insurance record to get entitled to a full State Pension and other benefits. Right now (April 2024) you can fill in gaps as far back as 2006 and you have until 5 April 2025 to do so. That covid-era concession will narrow down next year.

We hope you find these useful and welcome your feedback.

Advice index Freelance Fees Guide

Advice index Freelance Fees Guide

Benefits and pensions Freelance Fees Guide

Benefits and pensions Freelance Fees Guide

Visas and paperwork Freelance Fees Guide

Visas and paperwork Freelance Fees Guide

![[Freelance]](../gif/fl3H.png)