Get a bargain from the UK government

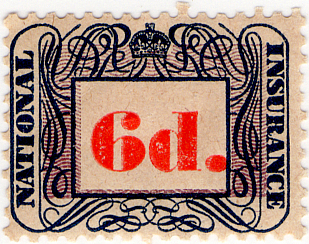

Back in the day, you proved your entitlement to a pension by buying actual stamps and sticking them in a book. This one's from 1948, the year of creation of the National Health Service

NOW WOULD be the perfect time to check whether you can claim a bargain from the UK government. That is the opportunity to top up your UK state pension. The people at moneysavingexpert.com reckon that you may get back 40 times what you pay in. That's right - one person told them:

I've managed to buy an additional 5 NI years for a total £814 (turns out I'm eligible to pay class 2 NI contributions). This has increased my State Pension forecast from £192 to £221.20 a week, so £1622 a year. If I live to my average life expectancy of 87, it'll total out at £34,070.

It works like this: The standard basic UK state pension for a single person is £221.20 per week. It is payable from your 66th birthday if you were born on or before 5 April 1960, provided that you have paid at least 35 years of National Insurance (NI) contributions. If you have fewer years of contributions you get less; if you have fewer than 10 years you may get nothing. It has, however, been possible to get away without paying the “Class 2” contributions that determine your eligibility for a State Pension.

You can currently fill in gaps as far back as 2006 and you have until 5 April 2025 to do so. After then, your contribution record more than six years ago will be locked.

After that date, if you have self-employed profits of at least £6725 per year you are “treated as having paid” Class 2 contributions. But you really should top up earlier years.

Update On 6 April the "new State Pension" increased to &pounbd;230.25 per week. You can now fill in gaps in your National Insurance record only six years back.

Urgently consider buying National Insurance years moneysavingexpert.com

Urgently consider buying National Insurance years moneysavingexpert.com

Tax and National Insurance Freelance Fees Guide

Tax and National Insurance Freelance Fees Guide

Voluntary National Insurance gov.uk

Voluntary National Insurance gov.uk

![[Freelance]](../gif/fl3H.png)