Crisis cash - what help is still available?

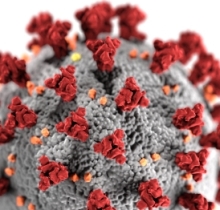

By no means over: a coronavirus

FIRST there was the covid crisis. Now there's the energy crisis and - for some - an interest-rate crisis. While the government wants us to pretend that the pandemic is over, the SARS-COV-2 virus is still refusing to co-operate. So too are the companies that supply gas and electricity - facing wildly fluctuating wholesale prices, not least as a result of Vladimir Putin's Gaspolitik - but somehow changing the retail price to us only upward. Then there's the fallout of the Truss/Kwarteng anti-budget, which will continue for years....

In addition to the government support described below we must refer members of the National Union of Journalists to the Union's charity NUJ Extra.

There is also now the Rory Peck Trust Crisis Fund for freelances.

The following is our best effort at a running summary of what support is still available to freelances whose income is affected by the polycrisis.

If you spot something missing, please email help@londonfreelance.org now. First, see these sections of this page:

- Household Support Fund

- Help with gas and electricity bills

- Local support for businesses

- Loans, mortgages and rent

- Universal Credit and other benefits

1. Household Support Fund

So-called Household Support Fund funding for local authorities has been extended again, until 31 March 2024, and again until 30 September 2024.

The money is managed by local councils. Each sets its own conditions.

To see what your local authority (council) offers, go to its website:

The rules vary widely, as does the name used locally for the household grants. As well as searching for "Household Support", try "hardship support", "[council name] Support Fund", "emergency support", "local welfare assistance", "crisis assistance", "crisis support scheme" or "Resident Support Scheme".

2. Help with gas and electricity bills

The government has announced a cap on energy prices, currently effective until 30 June 2023. This is widely misreported: if you see any mention of a cash cap, including any from a government source, note that the figure given is in fact for a "typical household". In addition, there was a £400 "discount" on bills last winter, deducted directly from them. Those with prepayment meters will have to go to a Post Office - or wherever they top up their key - to cash in a voucher "issued via SMS text, email or post".

If you have office space separate from your home, you should get a bill reduction through the Energy Bill Relief Scheme: help for businesses.

There are also direct payouts to those on low incomes. These include payments to pensioners and to people receiving Universal Credit.

As far as we can tell, these are all automatic - so there is no need to apply. As the government says, treat all invitations to apply as suspicious attempts at identity theft.

Also, just in case, check out the Warm Home Discount Scheme.

Energy bills support .gov.uk

Energy bills support .gov.uk

3. Local support for businesses

Some local authorities may still be offering "local support for businesses" and as a freelance you are of course "a business". In general, however, this scheme closed in England on 31 March 2022.

4. Loans, mortgages and rent

A Recovery Loan scheme was launched on 6 April 2021. In July 2022 it was extended for a further two years, likely until 30 June 2024.

The conditions are that your business is trading in the UK and:

- is viable; and

- is not in "difficulty".

The government will guarantee 70 per cent of these loans, with the lending institution bearing the rest of the risk. Lenders may now require personal guarantees, but not guarantees against your home.

See the British Business Bank for a list of 80-odd lenders.

Do take qualified financial advice before taking out a loan.

Loan payment deferral

Lenders must offer ominously-named "tailored help" - see, again, excellent MoneySavingExpert.com advice.

Rent

Those who rent are left with asking their landlord to discuss deferral.

The various tenancy hardship schemes have closed.

Help if you're struggling to pay rent moneysavingexpert.com

Help if you're struggling to pay rent moneysavingexpert.com

5. Universal Credit and other benefits

It may be worth trying to claim Statutory Sick Pay (SSP), if you are paid on a Pay As You Earn (PAYE) basis or work through a limited company. Statutory Sick Pay of £109.40 per week is available only from the fourth day of illness.

Everyone left out by the measures reported above - and who does not already claim another benefit - can apply for Universal Credit (UC). There are massive delays in the UC system - one that the Freelance believes was designed in the first place to deter claims.

Warning: The BBC reports people who were receiving Working Tax Credit having it cancelled when they started an application for Universal Credit. They did not even complete that application, because they were concerned that their savings would make them ineligible. So if you receive Working Tax Credit or any other "legacy" benefit - take great care.

We strongly recommend that before you apply for a new benefit you use the moneysavingexpert.com benefits calculator to check what the effect will be.

Everyone receiving Tax Credit, Child Tax Credit, Income Support, Income-based Jobseekers's Allowance, Income-related Employment and Support Allowance (ESA) and Housing Benefit without other benefits is due to be transferred to Universal Credit by 2024. The government has now declared that those moved will benefit from "transitional protection" to stop the amount they receive falling in the near term.

The "monthly standard allowance" for Universal Credit (UC) is now £368.74 (for over-25s, from 6 April 2023). You should get more if you have children, have a disability or "need help paying your rent".

Only those who have illnesses or disabilities that affect their ability to work can get ("old style") Employment and Support Allowance (ESA). This is £84.80 a week for the over-25s (from 6 April 2023).

You may be able to claim New Style Employment and Support Allowance with, or instead of, Universal Credit, depending on your National Insurance record. This is available for those who are ill or have a health condition or disability that limits their ability to work, and are not currently getting Statutory Sick Pay. We no longer find any reference to New Style ESA for those who cannot work while self-isolating because of covid-19.

What about savings for tax purposes?

The NUJ and sister unions pressed for the rules on savings affecting eligibility for Universal Credit to be relaxed for the duration. Instead, we got an accounting clarification. To quote moneysavingexpert.com again: "We've checked with Department for Work & Pensions, who confirmed that while they'd expect business savings to be in a business account, nevertheless 'if someone has money in their personal account to be used for business purposes, it won't be counted towards their capital'."

If your household has more than £6000 of savings that are NOT provably earmarked for such purposes, your UC entitlement starts to reduce. While you have £16,000, you get nothing. It would seem that, if you need to claim Universal Credit, you should simply declare the savings which are "truly personal".

Claims and advice

Contacting NUJ Extra the NUJ charity

Contacting NUJ Extra the NUJ charity

Rory Peck Trust launches Crisis Fund for freelances

Rory Peck Trust launches Crisis Fund for freelances

Benefits calculator entitledto.co.uk with moneysavingexpert.com

Benefits calculator entitledto.co.uk with moneysavingexpert.com

Help if you're struggling to pay rent moneysavingexpert.com

Help if you're struggling to pay rent moneysavingexpert.com

Coronavirus finance & bills help moneysavingexpert.com

Coronavirus finance & bills help moneysavingexpert.com

Employment status advice in the Freelance Fees Guide

Employment status advice in the Freelance Fees Guide

Discussion and lobbying

NUJ response to the March 2021 budget disappointment

NUJ response to the March 2021 budget disappointment

NUJ's last-ditch call for a freelance-friendly budget 28/02/21

NUJ's last-ditch call for a freelance-friendly budget 28/02/21

UK government under fire over #ForgottenFreelances nuj.org.uk 11 Nov 2020

UK government under fire over #ForgottenFreelances nuj.org.uk 11 Nov 2020

Calls for support for creative workers by more than 120 organisations

Calls for support for creative workers by more than 120 organisations

NUJ welcomes decision to extend universal credit changes 04/11/20 nuj.org.uk

NUJ welcomes decision to extend universal credit changes 04/11/20 nuj.org.uk

Help for the self-employed won't save everybody Financial Times - partly superseded, but look where it was published

Help for the self-employed won't save everybody Financial Times - partly superseded, but look where it was published

Pressing for pandemic payment NUJ campaigning Feb 2021

Pressing for pandemic payment NUJ campaigning Feb 2021

Our union lobbying for freelances the NUJ delivered in April 2020

Our union lobbying for freelances the NUJ delivered in April 2020

The log of previous versions - while there was covid-19-related help - is here.

![[Freelance]](../gif/fl3H.png)